Our Blog

529 College Savings Plans

Two types of state 529 college savings plans let you invest tax-free With all the uncertainty the pandemic has meant for the college-bound, one thing is certain: College costs are going to increase. But there’s an easy way to protect against big bills down the road....

Simplified PPP Forgiveness Form

New PPP Forgiveness Application for Loans Under $50K The Small Business Administration has released a new simplified PPP forgiveness form this week. Companies that borrowed $50,000 or less can now complete a one-page form that skips some calculations that made earlier...

FSA, HRA and HSA: Medical Savings Accounts That Cushion Costs

A medical savings account like an FSA, HRA or HSA let you set aside money tax-free that you can use to cover gaps in insurance coverage.

New Emergency COVID Grant for Bellingham Businesses

Working Washington Small Business Emergency Grants (WWSBEG 2.0) offer up to $10,000 in aid to Bellingham businesses hurt by Covid-19

Latest PPP Forgiveness News

The latest PPP forgiveness news reports some bankers advising borrowers to wait on applying for PPP loan forgiveness. Also, many banks are still readying their digital PPP forgiveness application process. And finally, the Internal Revenue issued a statement on whether lenders should report PPP forgiveness to the IRS.

Employee Or Contractor?

Is your new paid help an employee or independent contractor? If you answer these questions, you’ll know for sure. And you’ll keep the IRS happy.

IRS Targets Small Business Non-Filers, Fraud

IRS Strategy Targets Small Business Non-Filers to Fill Tax Gap The Internal Revenue Service says it’s missing $39 billion in lost taxes. With spending on the rise, the government sorely misses that lost revenue. So to find it, it’s going after the little guys. A new...

Julia’s Birthday a Big Success

Julia’s birthday was August 27 and we celebrated in our usual way – maybe too much!

Our Favorite Holiday!

Celebrating Jeri's Birthday Friday the 21st we observed our favorite holiday, which means celebrating Jeri's birthday! The birthday girl was celebrating her (garbled) brthday - you'd never guess it, would you? A yummy Mexican lunch was followed by the official...

Filers Getting a Tax Notice By Mistake

Did you get a tax notice from the IRS when you already sent a check? Thousands of filers are getting a bill in error that says they owe.

Clumsy Accountant or Conspiracy?

NHL Fans Say Clumsy Accountant May Actually Be Part of Draft Conspiracy Was he just a clumsy accountant ? Or was he in fact part of conspiracy to give the No.1 pick in the NHL draft to the New York Rangers? Some disgruntled hockey fans say the latter. Eight teams were...

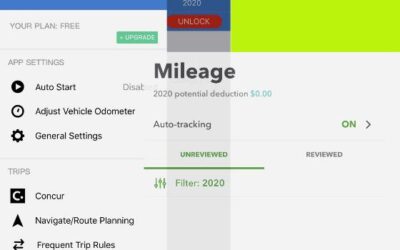

Track Your Mileage with an App for Tax Savings

If you track your mileage it can pay off big at tax time. Maybe you don’t drive for Uber or Lyft (or maybe you do), but using your car for business is still an expense. Driving to meet a client? Dropping a shipment off at the post office? Making a sales call? Track...

Our First Going Away Party, For Janna

So Long After three years of being apart of an amazing company, I'm saddened to leave. Jeri has given me one of the biggest opportunities of my life for professional growth. Not only that, but she gave me a pretty rad going away party with good food and great company....

Whatcom REstart Grants Help Businesses Hurt By COVID

Whatcom REstart grants offer up to $15,000 in aid to county businesses hurt by Covid-19

A Second Stimulus Check?

Another Stimulus Check? Now that we are in July, a discussion of another round stimulus check has been circulating. Remember, back in June, Congress hinted that talks of another check would have to wait until July. What Changes We Might See? An extension of...

Happy 30th Birthday Taryn!

Celebrating The Birthday Of Taryn An upgrade from our last quarantine birthday celebration, this time we got to go out! Taryn decided on Aslan as our destination. Nothing says small business accountant like going out and supporting one of our local restaurants. While...

New PPP Forgiveness News

Last week, the Senate approved an act that would streamline the PPP forgiveness process.

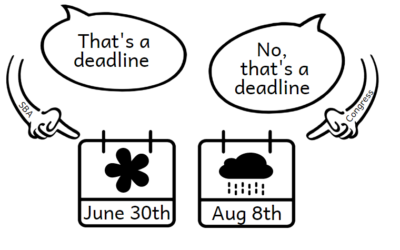

The Deadline For Applying For A PPP Loan

An Extension To The PPP Deadline The deadline to apply for the Paycheck Protection Program was supposed to expire on June 30th, but Congress unanimously agreed to extend the deadline to August 8th. Since more than $100 billion is still available in the PPP fund, it is...