If you track your mileage it can pay off big at tax time.

Maybe you don’t drive for Uber or Lyft (or maybe you do), but using your car for business is still an expense. Driving to meet a client? Dropping a shipment off at the post office? Making a sales call? Track your mileage! Those trips – at the IRS-approved rate of 57.5 cents a mile – add up in a hurry. The mileage deduction on your tax return is one that’s often overlooked, but it can really pay off.

These days, you can ditch the notebook to keep those trip records the IRS wants. Several apps are available for both Android and iPhones that can track your mileage automatically. Most work in a similar way: They mark the start of a trip when your car (with you and your phone inside) start moving. They track your route using your phone’s GPS. When you reach your destination, they stop. Then you swipe left or right to classify the trip as business or personal. At the end of the year, you’ll have a report detailing the mileage of all your trips.

If you use QuickBooks Online, you’re in luck. Every level of QBO includes a mileage tracker that’s free. Just download the QuickBooks app, adjust a few settings, and you’re literally good to go. Just about every client at Andrews Accounting subscribes to QuickBooks, and if that’s you, take advantage of this freebie! We’re happy to help getting you started if you need it.

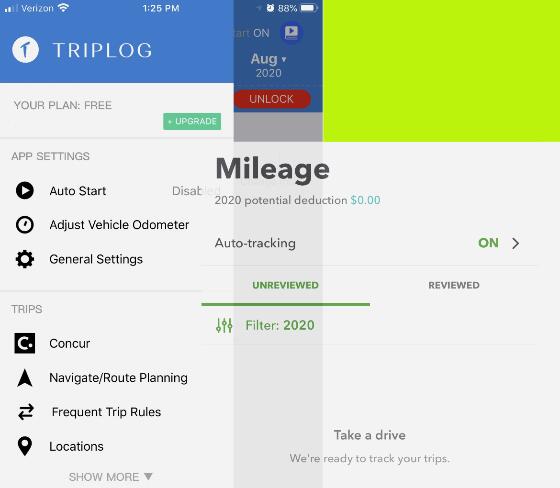

Another mileage tracker app is TripLog. TripLog has a free version, but you’ll need to enter your trips manually. Otherwise you’re looking at paying $4.99 a month for one user, or $5.99 a month for multiple vehicles. As a bonus, the paid version uploads your data to the cloud, giving you a backup if your phone dies.

Other tracker apps include MileIQ, which has a free version that allows up to 40 trips a month. The unlimited version is $4.99 a month, but also comes free with a Microsoft Office 365 Premium subscription. Another is Everlance, which can also be used to track revenue and expenses per job. Everlance costs $8 a month, or $60 for an annual subscription.

Get cracking on tracking!

Links

If you have an iPhone, you can visit the Apple App Store to download the QuickBooks app or search other mileage tracker apps.

If you have an Android phone, check out the Google Play Store.

Digital Trends has an article ranking the best mileage tracker apps for 2020 for small businesses.

Lastly, you can learn more about our services here!

Trackbacks/Pingbacks