Our Blog

Tax Credits, What Are They?

What Are Tax Credits? Tax credits are used to offset what you may owe in taxes. There are two types of these credits. Nonrefundable Credits Nonrefundable credits offset your tax bill and can go as far as getting you a refund. But your refund can only be as much as you...

IRA – Individual Retirement Account

An IRA (Individual retirement account) is a way to invest in your future and save for your retirement.

What Are All These Tax Forms For?

Every tax season, taxpayers’ files a multitude of forms to disclose various avenues of income, expenses and other financial data. There are so many, so let’s look at the most common ones.

Happy Valentine’s Day 2020

At the office, Valentine’s day isn’t just a holiday but the birthday of our very own Les Campbell. To celebrate we went to…

What’s a Gift Tax?

A gift tax is a tax on the market value of a gift. Also, the giver of the gift must give the gift with no hopes of getting anything in return.

Free Filing Software vs. an Accountant

Should you use TurboTax or another free filing software to do your taxes? It really depends on how complex your taxes are.

When Can You Expect a Tax Refund?

Tax season opened Monday, January 27th. Taxpayers with straight forward returns can expect their refund within 10-14 days of filing.

Big Changes For Salary Employees

At the beginning of the year, salary employees became eligible for overtime if they fall under certain criteria which is a threshold amount for a salary.

One Birthday and Then Another

Lauren's Birthday For Lauren's birthday, the team celebrated at Mykonos! Debra's Birthday For Debra's birthday, we went to the Filling Station where almost everyone got a milkshake. Links Additionally, learn more about our services here! Lastly, find more updates from...

Our Newest Employee, Lauren

Meet the newest addition to our team, Lauren Doerksen. You can learn more about Lauren’s background in our About Us section!

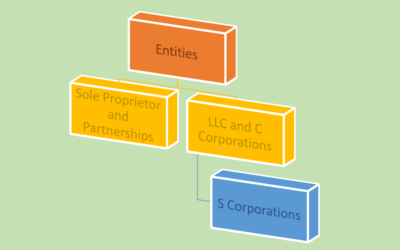

How do Business Owners Get Paid?

The salary of business owners depends on the entity of the business. There are five entities for businesses (C and S Corp, LLC, Sole Prop and Partners).

When Does Tax Season Begin?

In Other Words, When Will the IRS Accept Tax Returns? This does not mean that you have to wait until January 27th to file your taxes. You can file then as soon as possible, but your return will not be processed until the 27th. Additionally, the extension deadline for...

2020 Mileage Rates for New Years

mileage rates are used for taxpayers to be able to deduct the costs of operating a vehicle for business, medical and various other reasons.

Secret Santa

Decorating Jeri put on the star and then sat back and relaxed. The Secret Santa Exchange The gifts from our Secret Santa included games, utensils, scarfs, and hot chocolate. Food and Drinks The team went to Boundary Bay for some great food and a few drinks. Links...

We Are Moving

Moving! photo from David Goehring. When Are We Moving? We are moving three doors down from our current office. The new address will be 2620 N Harbor Loop Drive, Suite 21, Bellingham, WA 98225. Why Are We Moving? The new office will be twice as big as our current...

Our New Employee, Julia

When Jeri and Taryn went to the Job Fair at WWU this past fall, they happened to meet Julia Haven, an accounting student at WWU.

How to Prepare For Tax Season

What is the best present you can give yourself this holiday season? Getting in touch with a trustworthy tax preparer to get ready for tax season!

The Importance of Records

It is the taxpayer’s responsibility to have sufficient proof of business expenses. The best way to do this is to utilize an accountant!