Sole Proprietors and Partnerships

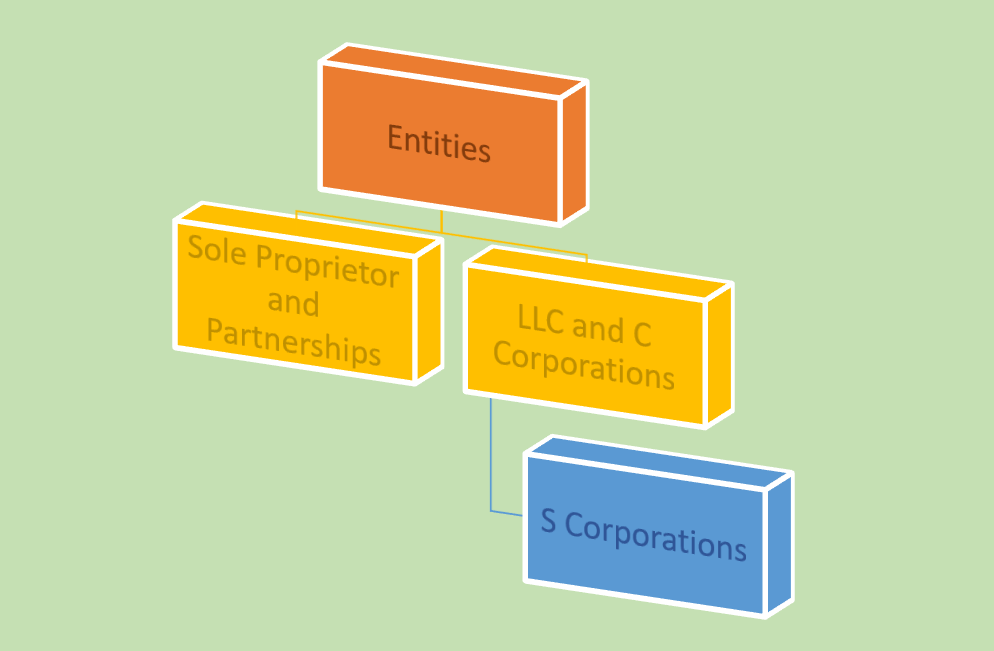

The salary of business owners depends on the entity of the business. Sole proprietors and partnerships pay themselves by taking money out of their business’s bank account.

What About Other Entities?

Limited liability company (LLC) owners are seen as members of their business. Owners of LLCs are treated as a sole proprietor (for single owners) or a partnership (for multiple owners). For payment, owners take money out of their share of the profit of the LLC. Owners of an LLC takes payment from taking out an owner’s draw. Owner’s draws are not paychecks, so owners of an LLC must make estimated tax payments every quarter. On the other has, an LLC can elect to be taxed as a corporation which means the company pays taxes instead of the owner.

S Corporation owners are seen as employees of the business. Owners of an S corporation come from either a C corporation or an LLC that has elected to be taxed as an S Corporation. S corporation owners pass the company’s profit, loss, etc. to their personal tax returns. Since S corporation owners are seen as employees, they are put on the company’s payroll. The remaining profit that is not paid out in wages is distributed to the shareholders of the company (these distributions are not subject to the same taxes as wages).

Links

Additionally, learn more from Nellie Akalp.

Lastly, learn more about our services here!

Recent Comments