Extensions And Your Tax Payment

Right now, the last thing on your mind is filing your tax return. With just about a month left to file, many taxpayers leaning towards extensions. Note that, although an extension lets you file your return by October 15th, you still need to pay your taxes by April 15th. If you do not pay your taxes by April 15th you will be subject to penalties, if you owe. To pay your taxes, you should make an estimate of what you will owe.

Filing Extensions

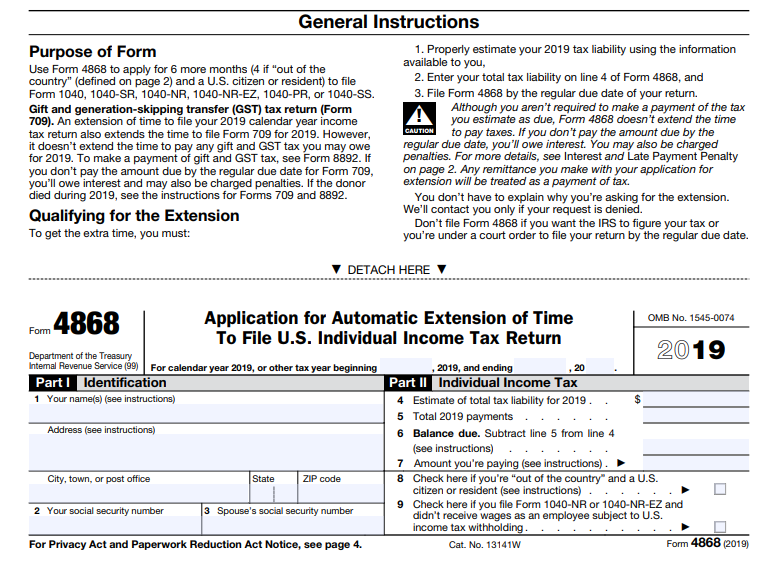

There are many ways to file for an extension. The easiest way to file an extension is to have your tax preparer do it for you. There are also many programs online that will file an extension for you. If you have access to a tax preparation software you can file your extension yourself. You should only file an extension on tax preparation software if you are familiar with how to use it. If you do not have access to programs or the internet, there is also a form you can mail in. The IRS has form 4868 for extensions which also comes with instructions on how to fill out the form.

Links

Learn more details from Kelly Phillips Erb.

Additionally, you can also find more information from the IRS.

Lastly, you can learn more about our services here!

Recent Comments