What are Mileage Rates?

Mileage rates are used for taxpayers to be able to deduct the costs of operating a vehicle for business, medical and various other reasons. Every year the mileage rates change so there are new 2020 mileage rates.

What are the New 2020 Mileage Rates?

For business use, taxpayers can deduct 57.5 cents per mile due to the new 2020 mileage rates. This deduction is calculated annually based on the costs of operating a vehicle. The mileage rate in 2019 was 58 cents per mile, so the deduction has decreased by half a cent.

For medical purposes, taxpayers can deduct 17 cents per mile. This deduction changes annually based on variable costs. In 2019, the medical deduction was 20 cents. Thus, this year we can see a decrease of 3 cents.

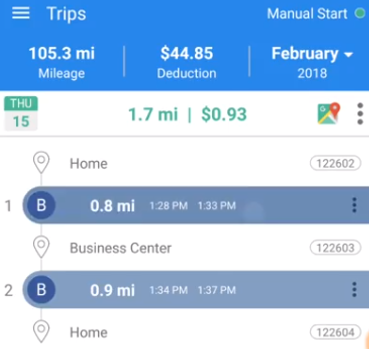

Additionally, there are many easy to use apps, take for example TripLog, that can help taxpayers track their miles.

Links

This mileage information comes from Michael Cohn which you can learn more about here.

Lastly, learn more about our services!

Recent Comments