Our Blog

The PPP EZ Application

Do You Qualify For The EZ Form? If one of the following scenarios applies to you, then you can submit the PPP EZ forgiveness application: You are self-employed with no employeesYou did not reduce your employees hours or reduce salaries by more than 25% (in the period...

2020 Graduate

A Graduate In 2020 Hi, I'm Janna. You may have seen me around the office sometimes, I'm there part-time. I run all the social media and marketing endeavors here at Andrews Tax Accounting. As you may have noticed, we like to keep you all up to date on the big events of...

Future PPP Changes To Consider

Possible Changes About $670 billion was put into funding PPP loans for small businesses. As of this week, about $130 billion still remains unused. With the job growth in May, the Treasury Secretary has stated that the SBA will be relaxing who is restricted from...

PPP Forgiveness Rules And Applying

When it comes to succeeding in getting your Paycheck Protection Program (PPP) loan forgiven, the government has repeatedly moved the goalposts. Now they’ve moved the goalposts to an entirely different stadium, but the good news is it’s a stadium that gives the borrower a little bit of home-field advantage.

The PP Flexibility Act

The Legislative Branch Yesterday, the Paycheck Protection Flexibility Act, a bipartisan bill, passed in the House of Representatives. The bill is expected to pass in the Senate, as well. Two Big Changes The first change to PPP loan forgiveness involves the period in...

Unemployment Benefits

Eligibility And Benefits If you were laid-off, furloughed or your place of business shut down due to COVID-19, you are eligible for unemployment benefits from Washington state and the federal government. The Employment Security Department (ESD) of Washington State has...

PPP Loan Forgiveness Rules Finalized?

The SBA has finally decided on the rules it will use to determine PPP loan forgiveness.

PPP Updates

PPP Loan Forgiveness Updates A stipulation to have a PPP loan forgiven is to prove COVID-19 has had a negative impact no your business. Recently this condition was nullified for small businesses with PPP loans less than $2 million. Other conditions still hold though....

PPP Loans and Deductions

Business Deductions and PPP Loans Tax deductions are subtracted from your adjusted gross income which results in paying a lower amount in taxes. Businesses can take advantage of many deductions to reduce their tax bill. Some common deductions for businesses are...

Some Good News

Julia Got Married In lieu of these times, some good news is overdue. Our newest member of the Andrews clan, Julia, was kind enough to share some of her wedding photos. A few weeks ago Julia tied the knot with her now-husband, Brandon. Here are some of the photos which...

Tracking Stimulus Checks

Stimulus Checks This week marks the third week of the IRS depositing stimulus checks directly into taxpayers’ bank accounts. If you have not received your stimulus check it is probably due to one of the following reasons: you are not eligible for a stimulus check, you...

Small Business Administration (SBA) Loans

Paycheck Protection Program The SBA is offering loans of up to $10 million to eligible small businesses to protect small business workers. The loan can be forgiven if employees are on the payroll for eight weeks and the loan is used for payroll, rent, utilities, etc....

When Can You Expect a Relief Payment?

The CARE Act The Care Act gives a relief payment of $1,200 to adults that make no more than $75,000 annually. This applies to couples that make $150,000 annually (in which the relief would be $2,400). Also, each child under 17 years-old amounts to an additional $500...

Small Business Loans

The CARES Act Part of the relief from the CARES Act is for small businesses. To keep workers employed and small businesses open, $350 billion dollars has been allocated towards small businesses. Additionally, these loans may be forgiven if small business owners...

An Act and Taxes

Part of the CARES Act Each adult will receive $1,200 ($2,400 for couples) in relief and $500 per child. Relief payments are based on your adjusted gross income reported on your 2019 tax return. Some ineligible payments include children of the age of 17-18 years old,...

New Tax Deadline

Tax Season Extended Tax Day has been moved from April 15th to July 15th. So, not only do taxpayers have more time to file their business and personal returns, but no penalties or interest will accumulate between April and July as well. Small Business With request the...

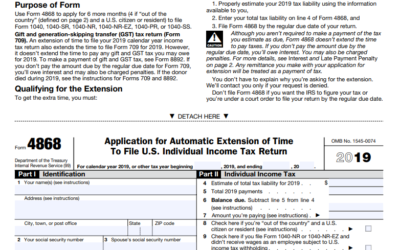

Everything You Need To Know About Extensions

Extensions And Your Tax Payment Right now, the last thing on your mind is filing your tax return. With just about a month left to file, many taxpayers leaning towards extensions. Note that, although an extension lets you file your return by October 15th, you still...

Breakfast During Tax Season

The Goodies At Breakfast With the stress of tax season, we decided to relax with a team breakfast. We all brought homemade treats such as cinnamon rolls, french toast, muffins, eggs bacon, and fruit. Links Learn more about our services here! Lastly, follow us on...