PPP Loan Forgiveness Updates

A stipulation to have a PPP loan forgiven is to prove COVID-19 has had a negative impact no your business. Recently this condition was nullified for small businesses with PPP loans less than $2 million. Other conditions still hold though. At least 75% of the loan must be spent on payroll and up to 25% can be spent on business expenses (rent, mortgage interest, and utilities). Additionally, the loan must be used within eight weeks of receiving it to be forgiven.

If you spend more then 25% of your PPP loan on business expenses then the forgivable amount will be lowered until it reaches a ratio of 75-25 of payroll to business expenses. The rest of the PPP loan will become a loan with an interest rate of 1%. It also must be paid off within two years of receiving the loan.

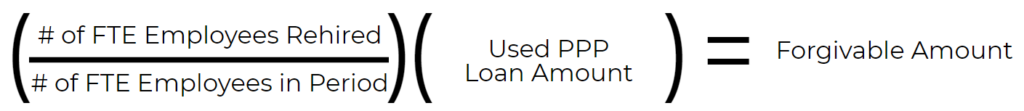

Spending 75% of your PPP loan on payroll may sound simple, but small business owners will be penalized if they do not hire back a certain number of employees. The number of employees you must hire back is based on how many full-time equivalent employees you had in either January 1, 2020, to February 29, 2020, or February 15, 2019, to June 30, 2019 (choose the period in which you had fewer employees). If you fail to hire back the same number of employees (FTE) from one of those chosen time periods then your loan (or the amount you spent) will be deducted based on the ratio of FTE employees that were not hired back.

One issue many employers are facing is that employees do not want to return to work. The SBA has a solution. *If you find that your employee(s) does not want to come back, you should document requesting to rehire them and their rejection of the offer. Then the number of FTE employees from the period of time chosen will be reduced by however many employees refuse to come back to work. Thus, more of the PPP loan becomes forgivable.

*Subject to change: The SBA has stated that documenting trying to rehire laid-off employees is no longer able to reduce loan forgiveness. The SBA also states this will change again in the future (As of 5/19/20).

Many business owners have yet to receive a PPP loan or even apply. On May 10th, there was $120 billion out of $320 billion in funding left. There is still hope to get a PPP loan! On the other hand, if you have a PPP loan and wish to return it, you have until May 18th.

Links

Find more about PPP loan updates from Morgan Simon and Jeff Drew.

Additionally, Mat Sorensen has a lot of information about PPP loans here and here.

Plus, the SBA answered questions about PPP loans here.

Lastly, learn more about our services!

Recent Comments