by Andrews Tax Accounting & Bookkeeping | Mar 20, 2020 | Educational

Tax Season Extended Tax Day has been moved from April 15th to July 15th. So, not only do taxpayers have more time to file their business and personal returns, but no penalties or interest will accumulate between April and July as well. Small Business With request the...

by Andrews Tax Accounting & Bookkeeping | Mar 11, 2020 | Educational

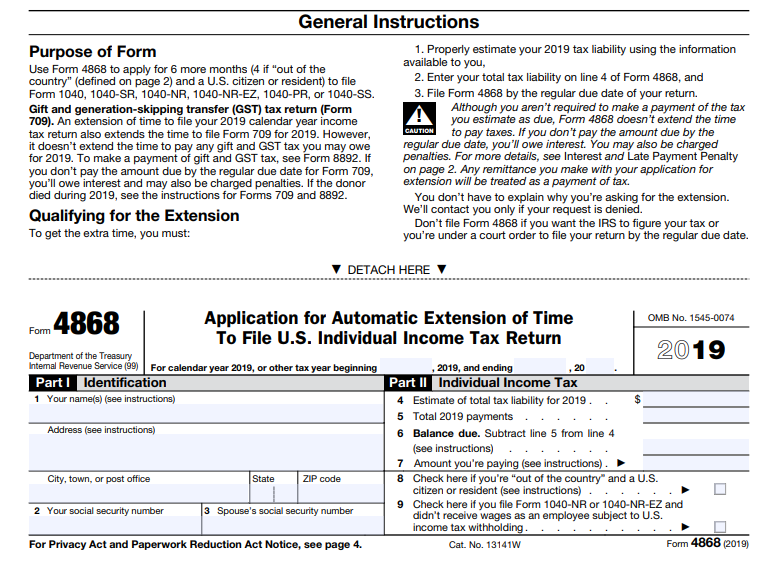

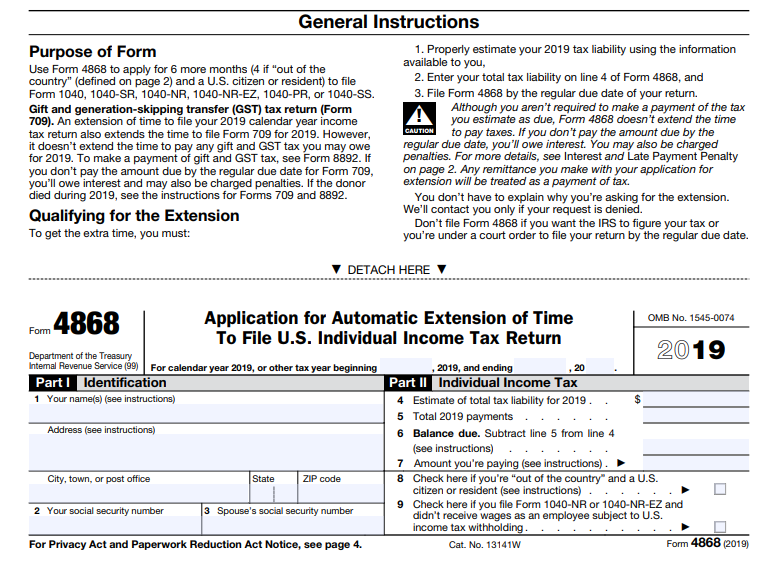

Extensions And Your Tax Payment Right now, the last thing on your mind is filing your tax return. With just about a month left to file, many taxpayers leaning towards extensions. Note that, although an extension lets you file your return by October 15th, you still...

by Andrews Tax Accounting & Bookkeeping | Mar 4, 2020 | Educational

What Are Tax Credits? Tax credits are used to offset what you may owe in taxes. There are two types of these credits. Nonrefundable Credits Nonrefundable credits offset your tax bill and can go as far as getting you a refund. But your refund can only be as much as you...

by Andrews Tax Accounting & Bookkeeping | Feb 26, 2020 | Educational

Defining IRA An IRA is a way to invest in your future and save for your retirement. There are four main IRAs all with different advantages. Four Different IRAs Contributions to a traditional individual retirement account are usually tax-deductible. When you take money...

by Andrews Tax Accounting & Bookkeeping | Feb 19, 2020 | Educational

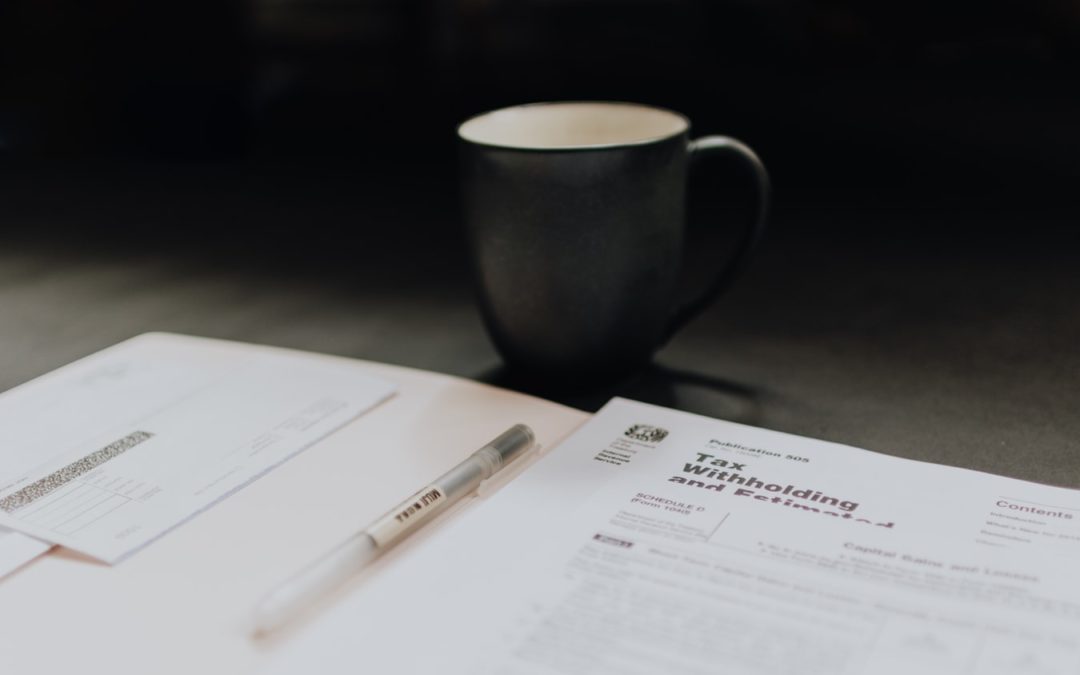

Tax Season Every tax season, taxpayers file a multitude of forms to disclose various avenues of income, expenses and other financial data. There are so many, so let’s look at the most common ones. Form 1040 This form is used by taxpayers to file an annual income tax...

by Andrews Tax Accounting & Bookkeeping | Feb 12, 2020 | Educational

Gift Taxes and the Oscars A gift tax is a tax on the market value of a gift which can be a physical object, money or property. Additionally, the giver of the gift must give the gift with no hopes of getting anything in return except of course a “thank you” hopefully....

Recent Comments