by Andrews Tax Accounting & Bookkeeping | Aug 7, 2020 | Educational

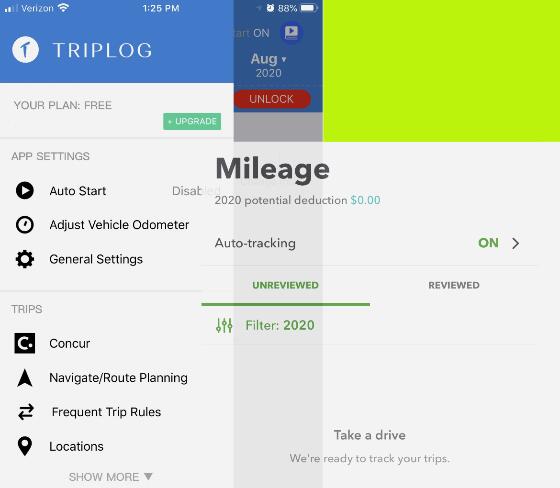

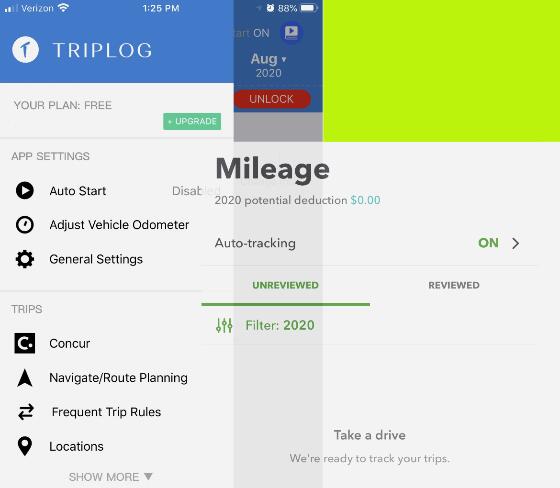

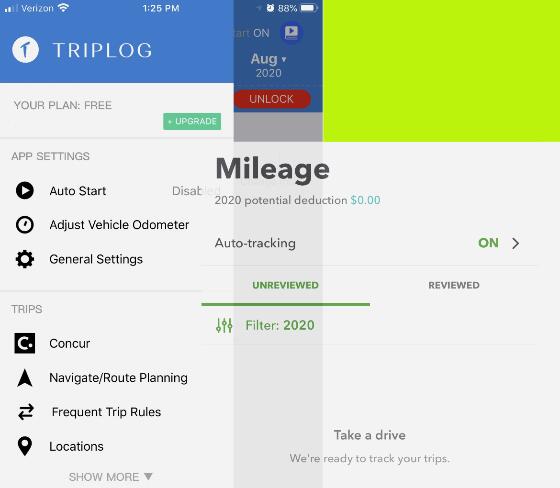

If you track your mileage it can pay off big at tax time. Maybe you don’t drive for Uber or Lyft (or maybe you do), but using your car for business is still an expense. Driving to meet a client? Dropping a shipment off at the post office? Making a sales call? Track...

by Andrews Tax Accounting & Bookkeeping | Jul 22, 2020 | Educational

Companies Can Receive Up To $15K In Free Aid More Covid-19 help is on the way for local companies. You can apply for Whatcom REstart grants designed to help recover from economic injury due to the pandemic. The county-wide initiative will issue up to $2.6 million in...

by Andrews Tax Accounting & Bookkeeping | Jul 17, 2020 | Educational

Another Stimulus Check? Now that we are in July, a discussion of another round stimulus check has been circulating. Remember, back in June, Congress hinted that talks of another check would have to wait until July. What Changes We Might See? An extension of...

by Andrews Tax Accounting & Bookkeeping | Jul 9, 2020 | Educational

Feds May Simplify PPP Forgiveness Last week, the Senate approved an act that would streamline the PPP forgiveness process. The good news? The act would reduce the forgiveness application to one page for loans under $150,000. This new application would basically be...

by Andrews Tax Accounting & Bookkeeping | Jul 3, 2020 | Educational

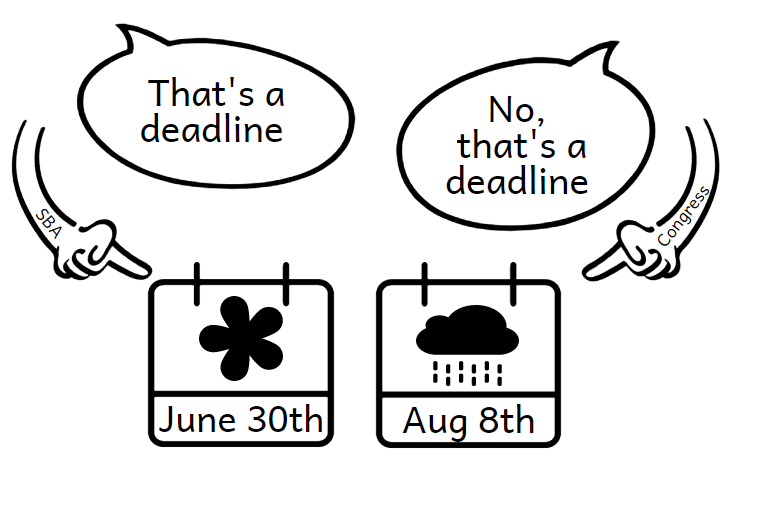

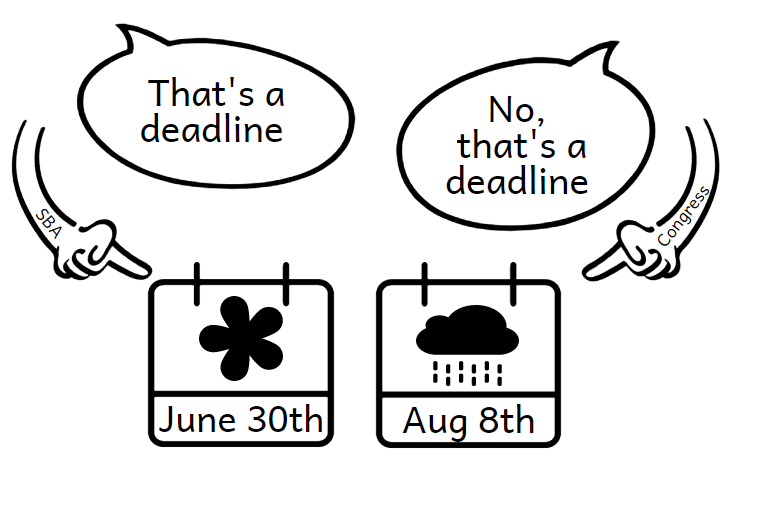

An Extension To The PPP Deadline The deadline to apply for the Paycheck Protection Program was supposed to expire on June 30th, but Congress unanimously agreed to extend the deadline to August 8th. Since more than $100 billion is still available in the PPP fund, it is...

by Andrews Tax Accounting & Bookkeeping | Jun 26, 2020 | Educational

Do You Qualify For The EZ Form? If one of the following scenarios applies to you, then you can submit the PPP EZ forgiveness application: You are self-employed with no employeesYou did not reduce your employees hours or reduce salaries by more than 25% (in the period...

Recent Comments