by Andrews Tax Accounting & Bookkeeping | Jun 20, 2024 | Educational

If There’s a Stock Market Crash, You’ll Want to Prepare Is a stock market crash on the horizon? Stock prices keep climbing right now, but several experts say the bubble is due to burst soon. But don’t despair – there are steps you can follow to weather the storm. Some...

by Andrews Tax Accounting & Bookkeeping | Feb 7, 2024 | Educational

Different Requirements Determine Who Has to File a Tax Return You might think everyone living in the US has to file a tax return. But there are some folks who don’t. Here’s how to figure out if you’re one of the lucky few. Gross Income The most obvious determining...

by Andrews Tax Accounting & Bookkeeping | Dec 27, 2023 | Educational

Prepare for a Minimum Wage Hike State-Wide and In Bellingham Minimum Wage Hike A minimum wage hike is set to take effect on January 1, 2024, and workers in Bellingham can expect another minimum wage hike starting May 1, 2024. The minimum wage in Washington is adjusted...

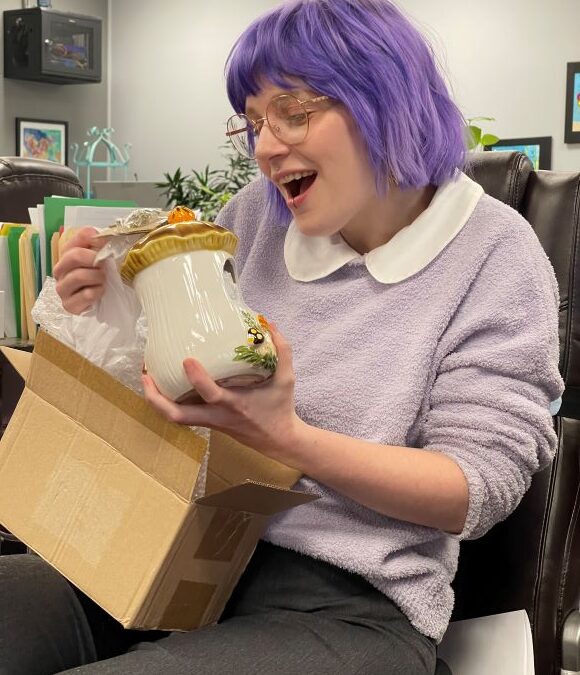

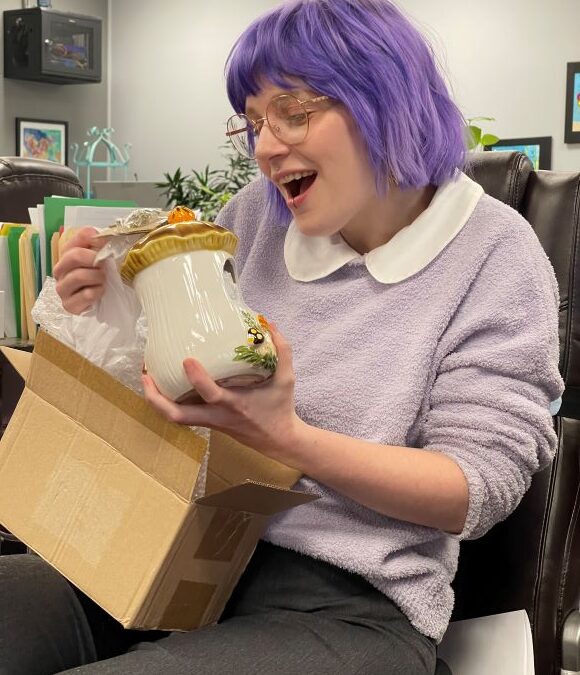

by Andrews Tax Accounting & Bookkeeping | Dec 22, 2023 | Amusement

Secret Santa’s Secret Is Revealed at the Andrews Wing-Ding Santa’s secret has been safe since the beginning of November. That’s when everyone drew names to become their lucky Andrews office mate’s Secret Santa. And Friday, December 22, all was...

by Andrews Tax Accounting & Bookkeeping | Dec 7, 2023 | Amusement, Holidays

We’ve Decked the Halls (Even if We Don’t Have Actual Halls) The office elves were a little slow to start your holidays, but once they got going, they couldn’t be stopped. Leading the way, head elf Emily. Emily hears those jingle bells – and...

Recent Comments