by Andrews Tax Accounting & Bookkeeping | Feb 3, 2021 | Educational

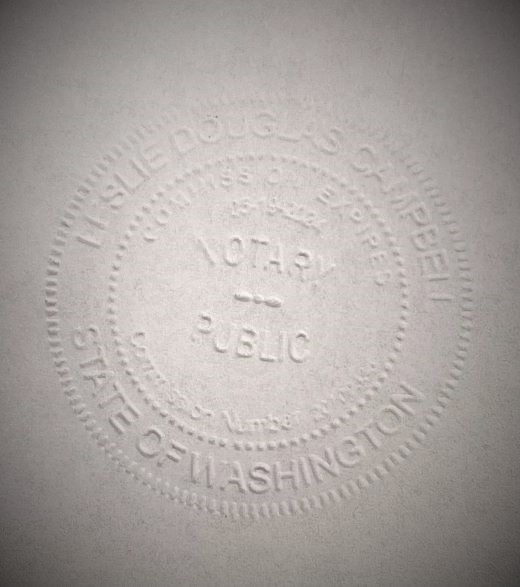

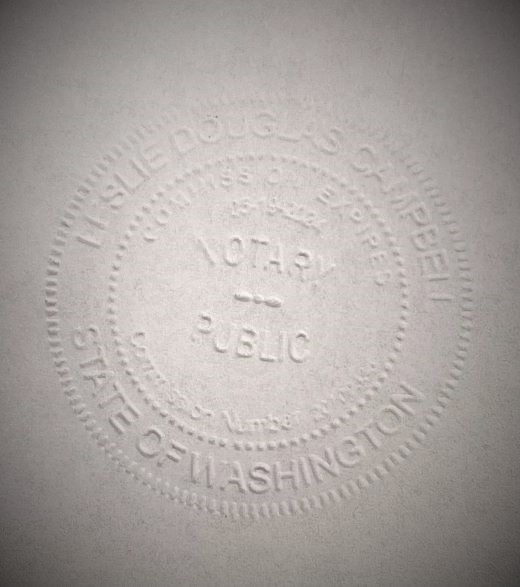

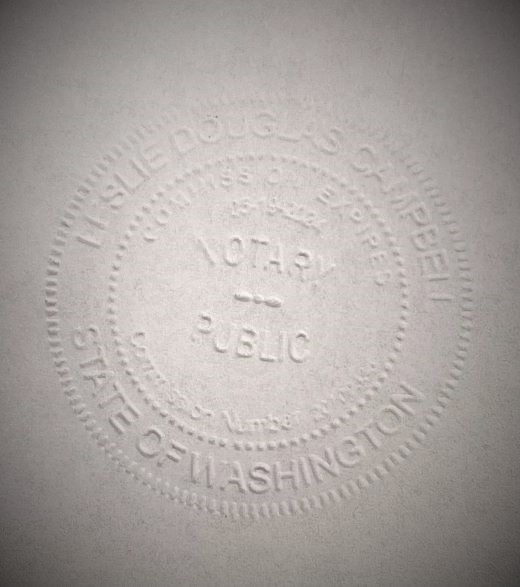

Andrews Accounting Offers Free Notary Services Do you need a document notarized? Andrews Accounting has a Notary Public on staff – that’s Les – and we offer free notary services to our clients. You don’t even need to make an appointment. But there are some things that...

by Andrews Tax Accounting & Bookkeeping | Jan 28, 2021 | Educational

Cash and Tax Considerations Affect Whether You Should Buy or Lease It’s time to buy a new company vehicle – should you buy or lease that car, truck or van? There are a few different factors to consider in deciding what’s best for you. Cash Considerations Buying a car...

by Andrews Tax Accounting & Bookkeeping | Jan 21, 2021 | Educational

Cryptocurrencies Can Involve Capital Gains and Income Taxes How does the Internal Revenue Service handle Bitcoin taxes? Like most questions for the IRS, the answer is, it depends. But with recent cryptocurrency prices soaring to new heights, you might like an answer...

by Andrews Tax Accounting & Bookkeeping | Jan 13, 2021 | Educational

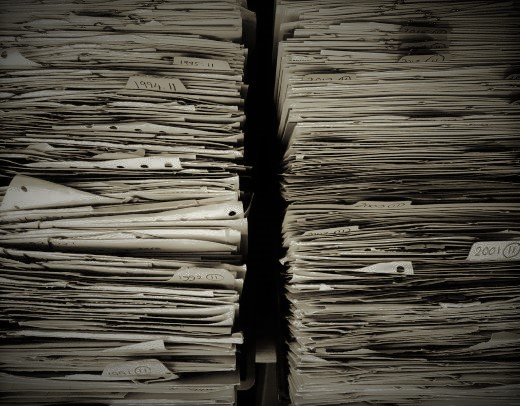

Keep Tax Records Somewhere Between 3 Years and Forever How long should you keep tax records? Like so many questions we ask the Internal Revenue Service, the answer is, “it depends.” Let’s go through different scenarios. Keep Tax Records 3 Years In general, the IRS has...

by Andrews Tax Accounting & Bookkeeping | Dec 30, 2020 | Educational

Latest PPP News Says Expenses Paid by PPP Loan Now Deductible In the latest PPP news, a new pandemic relief bill became law this week. Among the positive developments for small businesses, expenses paid by Paycheck Protection Program loans earlier this year are now...

by Andrews Tax Accounting & Bookkeeping | Dec 16, 2020 | Educational

Employee and Client Christmas Gifts Can Be Deductible As a company owner, you may be thinking of giving out employee and client Christmas gifts. Good for you – it’s a giving time of year! And the good news is, if you follow certain Internal Revenue Service...

Recent Comments