Keep Tax Records Somewhere Between 3 Years and Forever

How long should you keep tax records? Like so many questions we ask the Internal Revenue Service, the answer is, “it depends.” Let’s go through different scenarios.

Keep Tax Records 3 Years

In general, the IRS has three years from when your return was filed (or was due) to ask for an audit. Likewise, you as the taxpayer have three years to ask for an additional refund. That can happen if you discover an error, or because of other changes. For instance, in response to the money squeeze imposed by the pandemic, you are allowed to apply current losses against past tax bills. That could mean

What should you keep? Anything that backs up the numbers you entered in your return. That includes W-2 and 1099 forms, retirement statements, stock and mutual fund documents. In other words, everything you gave to your accountant. And if you itemized, you’ll want to keep the receipts that back up your expenses.

Er, 6 Years

It’s different if the IRS suspects that you fudged income numbers. You’ll want to keep your tax records six years to prove you didn’t. One of those fudged numbers the IRS doesn’t like is “substantially understating your income.” That means a difference of 25 percent or more between what you claimed and what you actually earned. That also applies to selling properties, if you overstate the amount you paid for it originally.

Um, Indefinitely?

Some records you’ll want to hold onto indefinitely. For example, if you buy a property, you’ll want to keep records of all your expenses the entire time you own the property. Then when you sell it, you’ll add everything you’ve paid to figure the total cost of your property (known as the basis). When you sell, you’ll want to keep those records at least another – here we are back to the beginning – three years.

The IRS wants you to file your taxes every year. But if you don’t – even if you don’t have to – they say to hold onto tax-related records indefinitely.

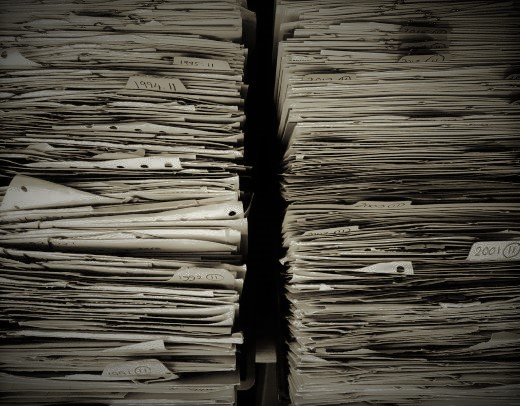

How to Keep Tax Records

If you have room, go ahead and hold onto your paper records. But it’s a good idea to make a second, digital, copy in case something happens to the paper copies. The digital copies should be kept in the cloud (online back up storage). There are a few different services that offer 5 GB of cloud storage for free. A good place to check first is your computer – a lot of manufacturers offer a “starter” amount of storage at no cost.

Links

Here’s what the IRS has to say about how long to keep records.

Another time period of interest? This Nolo article deals with how long the IRS can pursue you for unpaid taxes.

Lastly, you can learn more about our services here!

Recent Comments