Estimated Tax Payments Now Could Save You in the Long Run

Estimated tax payments are a way to pay as you go so you won’t be hit with a scary tax bill when you file. What’s more, if you make estimated tax payments (usually each quarter, or every three months), you can avoid a penalty. But don’t wait – the estimated tax payment for the fourth quarter of 2022 is due by January 17.

Who Should Make Estimated Tax Payments?

Estimated tax payments are taxes you pay to the IRS on earnings that don’t normally have withholding. Those include self-employment income, or payments you receive as an independent contractor or freelancer (which include jobs in the gig economy). As well, you might want to pay ahead if you have rental or investment income.

Another case for making estimated tax payments? If you owed money at tax time last year and your situation hasn’t changed, chances are you’ll owe again this year. Again – avoid that bill at filing time!

Why the Penalty?

The government wants you to pay 90 percent of your tax bill by the time you file. If you don’t, the IRS hits you with a penalty. The amount varies, but it can run to several hundred dollars.

How Much Should You Pay?

First option to figure out how big of an estimated tax payment to make: Ask your friendly accountant! Or, if you’re feeling shy, the IRS has an online Tax Withholding Estimator to help you.

How Do You Pay Estimated Tax Payments?

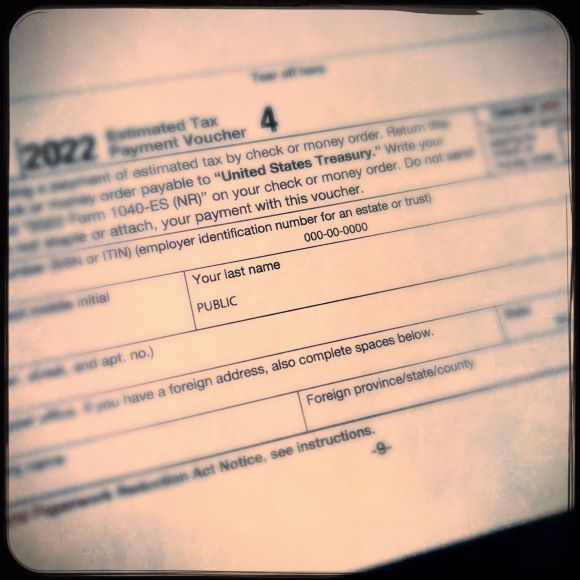

There are several ways to take care of your tax burden ahead of time. If you receive wages or a salary in addition to extra income, the easiest way to increase the withholding on your W-4. (You can submit a new one at any time.) Ways to pay include online, either by going to your IRS account, or using IRS Direct Pay. Or you can also fill out Form 1040-ES and mail it in.

Don’t Worry About Overpaying

If it turns out you make too big of an estimated tax payment, don’t worry. Come filing time, the IRS will refund any amount greater than the tax you owe.

Links

You can follow this link to download Form 1040-ES.

Lastly, you can learn more about our services here!

Recent Comments