by Andrews Tax Accounting & Bookkeeping | Sep 29, 2022 | Educational

Don’t Panic When an IRS Letter Arrives IRS letter can feel like a scary thing. But it doesn’t have to be. Here are steps to take when that ominous envelope arrives. Don’t Ignore an IRS Letter Whether or not the letter has bad news, the situation isn’t going to...

by Andrews Tax Accounting & Bookkeeping | Sep 9, 2020 | Educational

IRS Strategy Targets Small Business Non-Filers to Fill Tax Gap The Internal Revenue Service says it’s missing $39 billion in lost taxes. With spending on the rise, the government sorely misses that lost revenue. So to find it, it’s going after the little guys. A new...

by Andrews Tax Accounting & Bookkeeping | Jul 24, 2019 | Educational

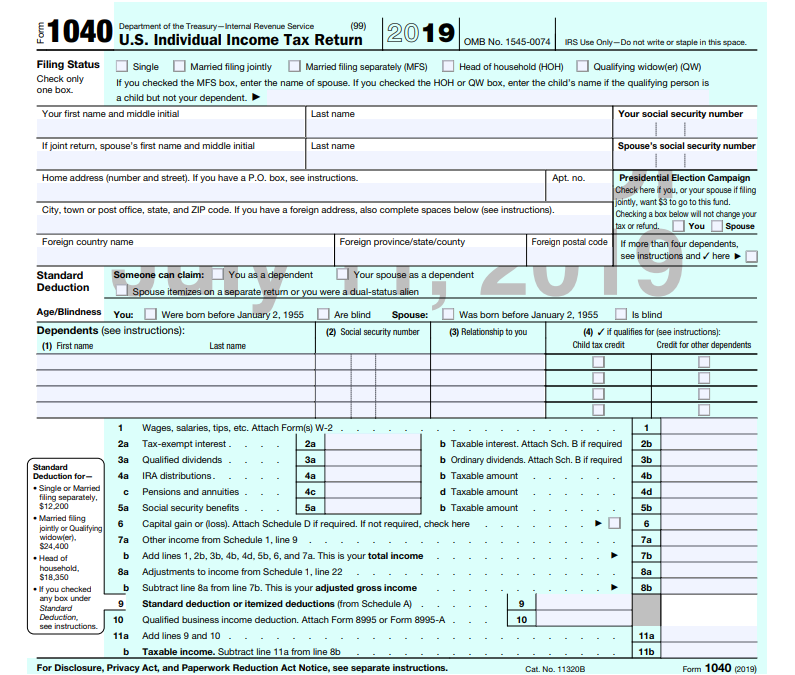

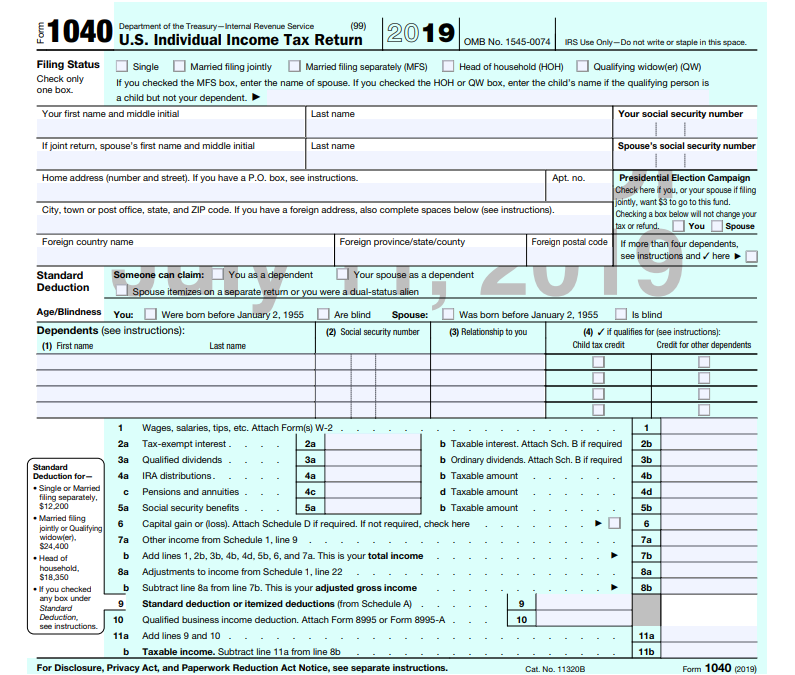

The Drafts The IRS recently posted drafts for Form 1040 and the tax return for senior citizens (Form 1040-SR) for the next tax season. The once postcard-sized Form 1040 is now almost a full-page, since the income reconciliation schedule return to the first page....

by Andrews Tax Accounting & Bookkeeping | Apr 17, 2019 | Amusement, Educational

Maurice Dreicer Want to deduct your personal meals? Well, that’s what Maurice Dreicer did. Business-related meals and entertainment (included in compensation) are one hundred percent deductible. Additionally, the expenses are not supposed to be extravagant. Now back...

by Andrews Tax Accounting & Bookkeeping | Jan 23, 2019 | Educational

Photo courtesy of EFile.com An Educated Guess Kelly Phillips Erb put together a lovely chart for taxpayers to estimate when they will receive their refunds. Note, this chart is an educated guess. With the shutdown and new tax laws, this season is going to be...

Recent Comments