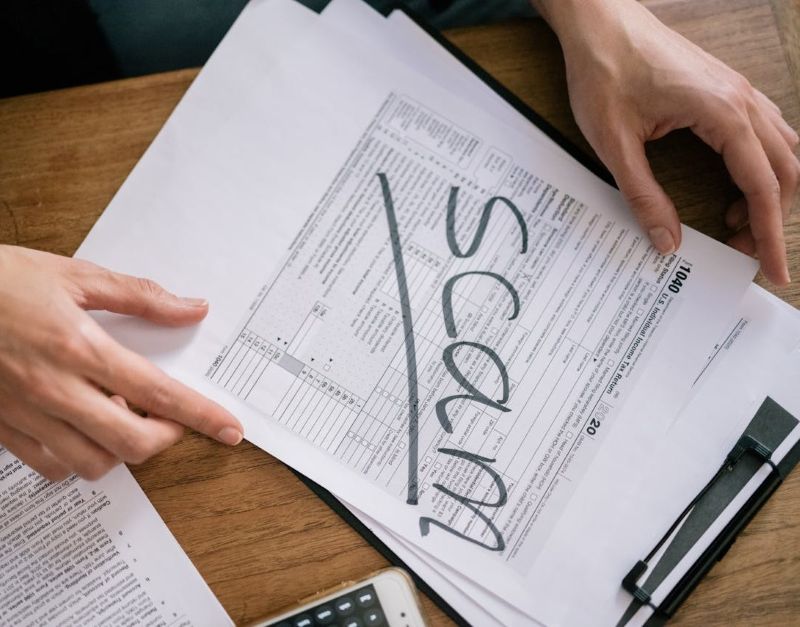

Warning Signs of Bogus Tax Preparers – When to Steer Clear

Warning signs of bogus tax preparers are something to keep in mind when deciding who will file your return. Unfortunately, there are unscrupulous preparers out there. If what they promise sounds too good to be true, it probably isn’t.

Warning Signs of Bogus Tax Preparers: Promising a Big Refund

Bogus tax preparers will often guarantee a big refund. They might claim that they know loopholes that other preparers don’t. A tipoff that something is wrong is when a preparer takes a percentage of the tax refund as their fee. That is, the higher the refund, the larger the preparer’s fee.

Fraudulent preparers will do things like overstate expenses, create phony business losses, fabricate medical expenses or make up education expenses. These generate undeserved tax deductions or credits that can create a large – but fraudulent – refund.

Warning Signs of Bogus Tax Preparers: Ghost Preparer

Beware of a tax preparer who won’t sign their name on a return – a “ghost preparer.” They prepare your return but refuse to sign it, leaving you to file it yourself. Preparers are required to sign returns and include their Preparer Tax Identification Number (PTIN). A ghost preparer might also ask you to sign an incomplete – or even blank – tax form.

Other Red Flags

- They ask you to have your refund deposited into a bank account they choose.

- They file using your last pay stub instead of your W-2.

- They don’t have a physical address, operating only online or coming to you.

- They require you to pay in cash.

What to Do

- Make sure your preparer has the proper credentials – an active PTIN is a good start, and check to see if they’re listed in the IRS directory.

- Look for a tax preparer who is around all year. It’s important to be able to communicate with your preparer when questions come up, whether on past returns or developing tax situations.

- Review your tax return carefully before signing it.

Links

Check out the IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications.

The IRS also has a webpage explaining how to make a fraud complaint against a tax preparer.

Lastly, you can learn more about our services here!

Recent Comments